Anúncios

The fintech industry in Indonesia is experiencing unprecedented growth, transforming the way financial services are accessed and delivered across the archipelago.

With a dynamic blend of innovation, digital adoption, and a massive unbanked population, the country has become a hotspot for both startups and investors looking to reshape financial ecosystems in Southeast Asia.

Anúncios

This thriving sector is driven by several key factors, including Indonesia’s young and tech-savvy population, the rapid rise of mobile internet penetration, and a government eager to support financial inclusion initiatives.

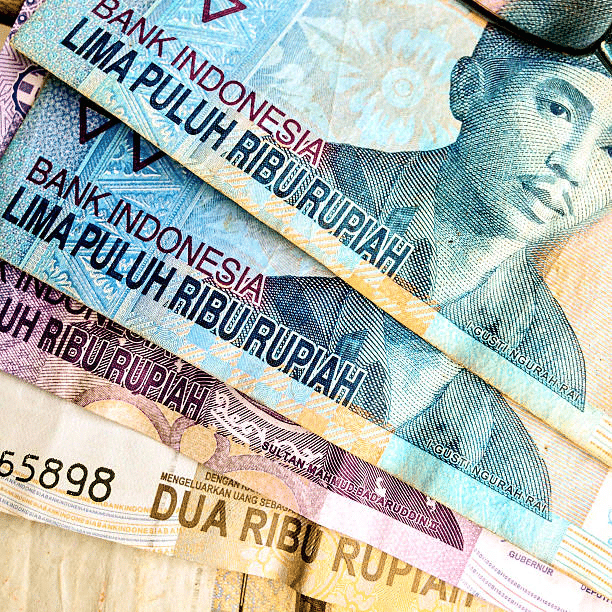

I would like to receive up to 200000 IDR?

Click here 👇

From digital payments and peer-to-peer lending to neobanks and blockchain-based solutions, the opportunities within Indonesia’s fintech landscape are vast and diverse.

Anúncios

In this exploration, we’ll dive deep into the major trends shaping Indonesia’s fintech market, the challenges it faces, and the lucrative potential it holds for businesses and entrepreneurs.

Whether you’re an investor, a tech enthusiast, or simply curious about the future of finance in emerging markets, understanding Indonesia’s financial landscape offers insights into one of the most dynamic economies in the region.

Indonesia’s Fintech Evolution: A Catalyst for Financial Inclusion

The Rapid Growth of Indonesia’s Fintech Ecosystem

Indonesia, the largest economy in Southeast Asia, has become a thriving hub for fintech innovation in recent years. With a population exceeding 270 million, over half of whom are under 30 years old, the country presents a fertile ground for digital financial solutions.

The rapid adoption of smartphones and growing internet penetration have provided the infrastructure for fintech startups to flourish. In fact, Indonesia is now home to more than 300 fintech companies, and the number continues to rise.

Several factors have contributed to this explosive growth. First, the government has actively supported fintech innovation through regulatory sandboxes and initiatives like the National Digital Economy Blueprint. Second, a large unbanked population—approximately 91 million Indonesians lack access to traditional banking services—has created an urgent need for alternative financial solutions.

This unmet demand has spurred the development of mobile payment platforms, peer-to-peer lending services, and digital wallets that cater to the financially underserved.

Indonesia’s fintech sector is not just growing—it’s transforming the way people interact with money. From small business owners gaining access to credit via digital platforms to everyday consumers embracing cashless transactions, fintech is driving financial inclusion at an unprecedented scale.

But what truly sets Indonesia apart is the sheer diversity of its fintech offerings, ranging from Islamic finance platforms to rural micro-lending solutions tailored to specific community needs.

The Role of Mobile Payments in Driving Financial Accessibility

One of the most significant fintech innovations in Indonesia is the proliferation of mobile payment systems. Platforms like GoPay, OVO, and Dana have revolutionized how Indonesians conduct transactions, allowing users to pay for goods, services, and even utility bills with just a few taps on their smartphones. These platforms are particularly vital in rural areas, where access to physical banking infrastructure is limited.

Mobile payments have not only enhanced convenience but have also introduced millions of people to the formal financial system. For instance, many Indonesians who previously relied on cash now have digital wallets that enable them to save money, make transfers, and build financial literacy.

Additionally, these platforms often partner with micro, small, and medium enterprises (MSMEs), helping local businesses expand their customer base and improve operational efficiency.

Interestingly, the pandemic accelerated the adoption of mobile payments. As social distancing measures made cash transactions less feasible, more Indonesians turned to digital wallets as a safer alternative.

This shift has had a lasting impact, with mobile payments becoming a staple in the country’s financial ecosystem. By bridging the gap between the unbanked and formal financial services, mobile payment systems are playing a crucial role in fostering economic resilience and growth.

Pioneering Peer-to-Peer Lending: Empowering Communities and Entrepreneurs

How P2P Lending is Transforming Access to Credit

Peer-to-peer (P2P) lending has emerged as one of the standout success stories in Indonesia’s fintech landscape. These platforms connect borrowers directly with lenders, bypassing traditional financial institutions. This model has proven particularly impactful in a country where access to credit has long been a challenge, especially for small businesses and individuals in rural areas.

Platforms like KoinWorks, Modalku, and Investree have made significant strides in democratizing access to funding. Entrepreneurs who previously struggled to secure loans from traditional banks due to strict credit requirements can now access funds through P2P lending.

These platforms use innovative credit scoring models that incorporate alternative data, such as social media activity and mobile phone usage, to assess creditworthiness, making it easier for first-time borrowers to qualify for loans.

Beyond supporting entrepreneurship, P2P lending has also fostered community-driven financial empowerment. Many platforms allow individual investors to contribute small amounts to fund loans, creating a sense of shared purpose and mutual benefit. As a result, P2P lending not only boosts financial inclusion but also strengthens social ties by enabling people to support each other’s financial goals.

Challenges and Regulatory Developments in the P2P Lending Sector

While P2P lending has undoubtedly brought about positive change, it is not without challenges. The rapid growth of this sector has raised concerns about fraud, data privacy, and default rates.

To address these issues, Indonesia’s Financial Services Authority (OJK) has implemented stricter regulations, including mandatory licensing for P2P platforms and caps on loan interest rates. These measures aim to protect both borrowers and lenders while fostering sustainable growth in the sector.

Additionally, the government is working to enhance financial literacy among the population, recognizing that education is key to mitigating risks in the P2P lending space. Initiatives like workshops and online resources are helping Indonesians make informed decisions about borrowing and investing through these platforms. By striking a balance between innovation and regulation, Indonesia is setting a benchmark for other countries navigating the complexities of fintech development.

Islamic Fintech: A Unique and Growing Niche

The Intersection of Faith and Finance in Indonesia

As the world’s largest Muslim-majority country, Indonesia has a unique opportunity to lead the development of Islamic fintech. This niche sector combines traditional Islamic financial principles, such as the prohibition of interest (riba), with cutting-edge technology to create ethical and inclusive financial solutions.

Platforms like Alami and Ammana are at the forefront of this movement, offering Sharia-compliant P2P lending, investment opportunities, and crowdfunding services.

Islamic fintech has garnered significant interest among Indonesians who prioritize financial products aligned with their religious beliefs. By providing alternatives to conventional banking, these platforms are empowering Muslims to participate in the financial system without compromising their values.

Moreover, the appeal of Islamic fintech extends beyond individual consumers; businesses are also adopting Sharia-compliant solutions to enhance their credibility and attract a broader customer base.

Indonesia’s leadership in Islamic fintech is not just a reflection of its demographic makeup but also a testament to its innovation-driven mindset. By leveraging technology to modernize Islamic finance, the country is setting an example for other Muslim-majority nations seeking to advance financial inclusion in a way that respects cultural and religious norms.

The Global Potential of Indonesia’s Islamic Fintech Sector

Indonesia’s Islamic fintech industry has the potential to make a significant impact on the global stage. With an estimated 1.9 billion Muslims worldwide, the demand for Sharia-compliant financial services is immense. Indonesian startups are already exploring opportunities to expand their reach beyond national borders, tapping into markets in the Middle East, South Asia, and Africa.

To support this international expansion, the Indonesian government and private sector stakeholders are working to establish partnerships and attract foreign investment. Events like the Indonesia Fintech Summit and collaborations with global Islamic finance organizations are helping to showcase the country’s expertise and capabilities in this niche market.

By positioning itself as a leader in Islamic fintech, Indonesia is not only addressing the financial needs of its own population but also contributing to the global movement toward more inclusive and ethical financial systems. This dual focus on local impact and international collaboration underscores the transformative potential of Indonesia’s fintech sector.

Future Horizons: Where Indonesia’s Fintech Sector is Heading

Emerging Trends Shaping the Fintech Landscape

As Indonesia’s fintech sector continues to mature, several emerging trends are shaping its future trajectory. One notable development is the integration of artificial intelligence (AI) and machine learning into financial services. These technologies are being used to enhance fraud detection, optimize credit scoring, and personalize user experiences, making financial products more accessible and secure.

Another exciting trend is the rise of embedded finance, where financial services are seamlessly integrated into non-financial platforms. For example, e-commerce websites and ride-hailing apps are increasingly offering payment and lending solutions, blurring the lines between different sectors. This approach not only enhances convenience for users but also opens up new revenue streams for businesses.

Additionally, there is growing interest in sustainable finance within Indonesia’s fintech ecosystem. Platforms are exploring ways to incorporate environmental, social, and governance (ESG) criteria into their offerings, aligning financial services with broader sustainability goals. This shift reflects a broader global trend toward using technology to address pressing social and environmental challenges.

Opportunities and Challenges on the Horizon

While the future of Indonesia’s fintech sector is undoubtedly promising, it also comes with challenges. Ensuring data security and privacy remains a top priority, especially as digital transactions become more prevalent. Strengthening cybersecurity measures and fostering consumer trust will be essential to maintaining the sector’s momentum.

Another challenge is the need for greater collaboration between fintech startups, traditional financial institutions, and regulatory bodies. By working together, these stakeholders can create an ecosystem that supports innovation while safeguarding consumers and promoting financial stability. Initiatives like open banking and API standardization are already paving the way for such collaboration, but there is still much work to be done.

Ultimately, Indonesia’s fintech sector is poised to play a pivotal role in shaping the country’s financial future. By embracing innovation, fostering inclusivity, and addressing emerging challenges head-on, Indonesia can unlock new opportunities not only for its own citizens but also for the broader global community.

Conclusion: Unlocking the Potential of Indonesia’s Fintech Sector

Indonesia’s fintech sector stands at the forefront of innovation, financial inclusion, and economic transformation, presenting a dynamic landscape filled with opportunities.

The rapid adoption of digital technologies, paired with government support and a vast unbanked population, has catalyzed the growth of fintech solutions such as mobile payments, peer-to-peer lending, and Islamic finance platforms.

These innovations are not only meeting the needs of underserved communities but also reshaping how individuals and businesses access and utilize financial services.

The rise of mobile payment systems like GoPay and OVO highlights how digital wallets are fostering accessibility and empowering micro, small, and medium enterprises (MSMEs).

Similarly, peer-to-peer lending platforms have democratized access to credit, enabling entrepreneurs and communities to thrive. Meanwhile, Indonesia’s leadership in Islamic fintech demonstrates the country’s ability to blend cultural values with cutting-edge technology, creating financial products with global appeal.

Looking ahead, the integration of artificial intelligence, embedded finance, and sustainable financial solutions will continue to drive growth in this sector.

However, challenges such as cybersecurity and regulatory compliance remain crucial areas to address. By fostering collaboration between stakeholders and embracing innovation, Indonesia has the potential to not only solidify its position as a regional fintech leader but also influence the global financial ecosystem.

The future of Indonesia’s fintech sector is undoubtedly bright, unlocking opportunities for economic resilience and inclusive growth.