Anúncios

Managing personal finances can feel overwhelming, especially when debt becomes a persistent obstacle.

However, taking control of your financial situation is not only possible but also increasingly accessible thanks to innovative tools and expert strategies.

Anúncios

Whether you’re struggling with credit card balances, student loans, or simply looking to improve your financial habits, the path to financial freedom begins with informed decisions and the right resources.

In this comprehensive guide, we’ll explore proven methods to tackle debt effectively and build a stable financial foundation. From budgeting techniques to leveraging cutting-edge financial apps, discover practical tips designed to simplify money management.

Anúncios

Learn how technology can empower you to track expenses, automate savings, and create long-term wealth, all while staying focused on achieving your goals.

By understanding key financial principles and integrating them into daily life, anyone can transform their relationship with money. Keep reading to uncover actionable steps that will help you break free from debt and unlock the freedom to live life on your terms.

How to Tame Your Debt Without Selling a Kidney

Debt, my friend, is like that party guest who doesn’t know when to leave. It shows up uninvited, eats all your snacks, and then sleeps on your couch for years.

But don’t worry—there’s a way to kick that freeloading debt out of your life without resorting to drastic measures like selling your collection of rare Beanie Babies or auctioning off your dignity on eBay.

Step 1: Know Thy Debt

Before you can tackle debt, you need to know what you’re dealing with. Think of it as preparing for battle—you wouldn’t fight a dragon without first figuring out how big it is, right? Make a list of all your debts: credit cards, student loans, car loans, that $50 you still owe your cousin from that one time you “forgot” your wallet at the restaurant.

Organize them by interest rate, and don’t forget to include any sneaky hidden fees.

Apps like Mint or YNAB (You Need A Budget) can help you track your debts and give you a clearer picture of the financial battlefield. These apps are like having a financial coach in your pocket, minus the whistle and yelling. They’ll help you see where your money is going and where you can cut back. Spoiler alert: it’s probably those daily lattes.

Step 2: Choose Your Debt-Destroying Weapon

There are two popular strategies for paying off debt: the Snowball Method and the Avalanche Method. Think of them like superheroes—one’s a flashy, feel-good type, and the other is more practical and calculated. With the Snowball Method, you pay off your smallest debts first, gaining momentum as you go.

It’s like eating your least favorite vegetables first so you can enjoy dessert sooner. On the other hand, the Avalanche Method targets the debts with the highest interest rates first, saving you more money in the long run. Either way, the key is consistency. Pick a method and stick to it like gum on the bottom of your shoe.

Budgeting: The Not-So-Secret Superpower of Financial Freedom

Let’s face it: budgeting has a bad reputation. It’s often associated with cutting out all the fun stuff in life—goodbye avocado toast, hello sadness. But the truth is, a budget isn’t a punishment; it’s a plan. It’s your financial GPS, guiding you away from the potholes of debt and towards the sunny beaches of financial freedom.

Step 1: Track Your Spending

First things first: you need to figure out where your money is going. And no, saying “it just disappeared” doesn’t count. Use an app like PocketGuard or Goodbudget to track your expenses, or go old school with a pen and notebook. You might be surprised to find out how much you’re spending on things like takeout, streaming subscriptions, or that one hobby you started and immediately forgot about.

Step 2: Create a Realistic Budget

Once you know where your money is going, it’s time to create a budget. But here’s the thing: your budget needs to be realistic. Don’t set yourself up for failure by trying to cut out every single luxury. Instead, prioritize your spending. Allocate funds for necessities like rent, utilities, and food, and then decide how much you can afford to put towards debt repayment. And yes, it’s okay to leave a little wiggle room for fun. Life is short—enjoy the occasional splurge, just don’t go overboard.

Innovative Apps That Make Managing Finances Fun (Yes, Really!)

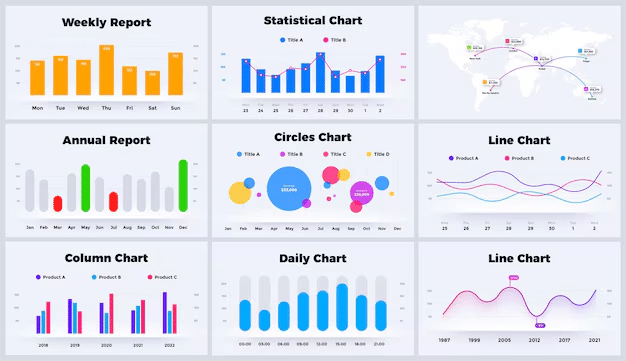

If the idea of managing your finances makes you want to crawl under a blanket and hide, you’re not alone. But thanks to technology, there are now apps that make budgeting and debt repayment less painful—and dare I say, even fun. Here are a few that might just change the way you think about money.

1. Acorns: The App That Turns Spare Change Into Savings

Acorns is like that friend who always picks up your loose change and gives it back to you later—except this friend invests it for you. The app rounds up your purchases to the nearest dollar and invests the spare change into a diversified portfolio. It’s a painless way to start saving and investing, and you don’t even have to think about it.

2. Digit: Your Personal Financial Assistant

Digit analyzes your spending habits and automatically saves small amounts of money for you. It’s like having a personal financial assistant who’s always looking out for your best interests. Plus, you can set specific savings goals, whether it’s paying off debt, saving for a vacation, or finally buying that air fryer you’ve been eyeing.

Breaking Bad Financial Habits Without Breaking a Sweat

Let’s be real: we all have at least one bad financial habit. Maybe it’s impulsive online shopping, or maybe it’s your weakness for overpriced coffee. Whatever it is, breaking bad financial habits is crucial if you want to achieve financial freedom. Here’s how to do it without losing your sanity.

Step 1: Identify the Habit

The first step to breaking a bad habit is recognizing it. Take a good, hard look at your spending habits and identify the areas where you’re overspending. Be honest with yourself—denial isn’t going to help your bank account.

Step 2: Replace the Habit

Once you’ve identified the habit, it’s time to replace it with a healthier one. For example, if you’re addicted to online shopping, try implementing a 24-hour rule: wait a full day before making any non-essential purchase. Or, if you’re spending too much on takeout, try meal prepping at home. Not only will you save money, but you might also discover a hidden talent for cooking. Or at least for not burning water.

The Power of Side Hustles: Boosting Your Income Like a Pro

Sometimes, cutting back on expenses just isn’t enough. If you’re serious about conquering debt and achieving financial freedom, you might need to boost your income. Enter the side hustle—a.k.a. the financial superhero you didn’t know you needed.

Step 1: Find Your Hustle

The beauty of side hustles is that there’s something for everyone. Whether you’re a talented graphic designer, a skilled writer, or just really good at assembling IKEA furniture, there’s a side hustle out there for you. Platforms like Fiverr, Upwork, and TaskRabbit make it easy to connect with people who are willing to pay for your skills. And if you’re feeling adventurous, you can even try your hand at selling handmade crafts on Etsy or flipping items on eBay.

Step 2: Make the Most of Your Time

Balancing a side hustle with your day job and personal life can be tricky, but it’s not impossible. The key is to manage your time wisely. Set specific hours for your side hustle, and stick to them. And don’t forget to take breaks—burnout is real, and it’s not going to help you achieve your financial goals.

Financial Freedom: It’s Closer Than You Think

Achieving financial freedom might seem like an impossible dream, but it’s not. With the right mindset, a solid plan, and a little help from technology, you can take control of your finances and build the life you’ve always wanted. So what are you waiting for? Start today, and remember: every journey begins with a single step. Or in this case, a single payment on that old credit card balance.

Conclusion: Your Roadmap to Financial Freedom Starts Here

Mastering your finances and achieving financial freedom is not a pipe dream—it’s a tangible goal that begins with actionable steps.

By understanding your debt, implementing smart strategies like the Snowball or Avalanche Method, and embracing innovative budgeting tools, you can take charge of your financial journey.

Apps like Mint, YNAB, and Digit empower you to track spending, plan budgets, and even automate savings, ensuring your path to financial stability is not only effective but also engaging.

Breaking bad financial habits is another cornerstone of financial success. Identifying where your money leaks and replacing poor habits with productive ones—like meal prepping or practicing a 24-hour rule for purchases—can significantly transform your financial outlook.

And for those looking to boost their income, side hustles offer endless opportunities. From selling your skills on Fiverr to flipping items on eBay, increasing your earnings can supercharge debt repayment and savings goals.

Financial freedom is closer than you think. It’s about consistency, planning, and making the most of the resources available to you.

Start today, harness the power of technology, and stay committed to your goals. Remember, every step, no matter how small, brings you closer to kicking debt to the curb and living the life you’ve always dreamed of. The journey to financial empowerment starts now—take that first step!